What is DGFT BRC online? How to complete e-BRC download?

Is your business involved in exports in India? If you are, the DGFT BRC or the e-BRC is a vital document for you, since it serves as a proof of payment from the buyer’s end in return for your exports of products or services.

If you are yet unaware of the functions of e-BRC, worry not! This article aims to cover the importance of DGFT BRCs for you, along with answering important questions like ‘what is the e-BRC full form?’, ‘how to obtain the e-BRC certificate?’, and ‘how to accomplish e-BRC download?’!

The e-BRC full form is Electronic Bank Realisation Certificate. The e-BRC certificate is issued by authorised banks in India under the guidance of the RBI. Its primary purpose is to validate the repatriation of export proceeds to the country and ensure compliance with foreign exchange regulations.

DGFT BRC replaces the traditional paper-based Bank Realisation Certificate (BRC) and embraces a more streamlined and efficient electronic format.

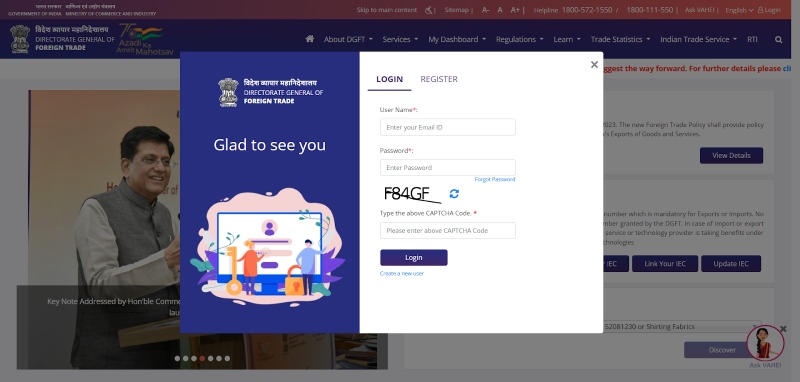

Here’s the entire working process of obtaining e-BRC on DGFT at a glance:

As you wonder about e-BRC details and downloading e-BRC certificate, you must know the core attributes of DGFT BRC:

BRC download: check e-BRC status, and view and print BRC

Here’s how you should go about a BRC download:

So now you are down with e-BRC download, but how do you claim export incentives with your DGFT BRC?

Do remember to check if your bank’s reported DGFT BRC value reflects the total realised value, and if not, have it corrected.

If your business is involved in export, the DGFT BRC is a crucial document since it acts as concrete proof of repatriation of export proceeds, and proves that you are complying with foreign exchange regulations and demonstrating the legitimacy of funds. Further, e-BRC on DGFT facilitates hassle-free access to various export incentives and benefits offered by the government, while also enhancing the transparency and credibility of exporters in the global market.

Now, the e-BRC on DGFT is just one of the many, many regulatory factors you need to be aware of if your business works globally. International finance can be pretty complicated after all, what with all the compliance measures you need to be aware of, along with currency conversion and exchange rates. However, this is where SALT Fintech can be a comprehensive solution for you!

With SALT Fintech, you have the convenience of enjoying global finance with local accounts! We take care of automated filings for several regulatory bodies including the RBI, FEMA, and MCA, so you can stay stress-free on the compliance aspect. Further, we have a transparent fee structure of 1.75% with no forex markup, and we use live exchange rates from Google while letting you receive international transactions in seven foreign currencies!

What’s more, the cross-border transfers you receive are processed immediately to your linked bank account with no holdup!

Visit us today to find out more about the services of SALT Fintech, and take your business to new heights!

e-BRC is mandatory for all export transactions as per the notations set by the Reserve Bank of India. It is crucial for exporters to obtain and submit the e-BRC on DGFT to demonstrate compliance with foreign exchange regulations and validate the repatriation of export proceeds.

Authorised banks can issue e-BRC for past export transactions upon submission of the required documents and fulfilment of applicable regulations. This allows exporters to rectify any previous gaps in documentation and ensure proper compliance retrospectively with DGFT BRCs.

The FIRC or Foreign Inward Remittance Certificate acts as a legal proof of inward remittances made to India in foreign currencies. Authorised banks issue it upon uploading the receipt of payment on the EDPMS or Export Data Processing and Monitoring System.